Shifting gears: Can R&D revitalise an industry in decline?

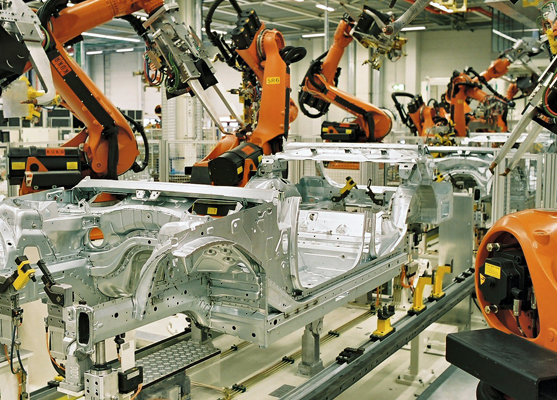

In a country where the physical production of cars has become outmoded, can continued investment in automotive R&D help establish leading roles in the manufacturing supply chains of the future?

In the context of Australia’s post-mining boom transition to a more knowledge-based economy, investment in research and development (R&D) is vital in preserving and developing the skills and technologies necessary to keep up with future trends in advanced manufacturing. Can high-tech automotive R&D, in particular, help drive the creation of new value- chains in the national economy?

In August, almost a year after car manufacturing wrapped-up in Australia, General Motors announced plans to employ 150 more engineers at Holden’s Port Melbourne facility, where they will join the company’s global Advanced Vehicle Design (AVD) team dedicated to the development of autonomous and electric vehicle technology. The positions are expected to be filled by the end of 2019, bringing the Australian design, engineering and development team to over 500 in number.

According to David Chuter, Innovation Manufacturing CRC (IMCRC) CEO, Holden is one of many companies currently demonstrating that Australia continues to be well respected for its design and engineering capability.

“I think this is a big yes-vote for the capability we do have in Australia to design, engineer and create great products for manufacturing,” Chuter told Manufacturers’ Monthly. “While these future vehicles won’t be made in Australia, it doesn’t mean that we don’t have still a significant amount of value to add to the car industry, globally speaking.”

Holden follows Ford, which in 2016, provided $450 million – representing a 50 per cent increase – to the company’s Australian research and development budget, supporting the expansion of its engineering, design and technician workforce from 1100 to 1750. As with Holden, the effort is aimed at developing fully autonomous car technology for commercial vehicles by the early 2020s.

Still, according to Chuter, without the direct link between R&D and every stage of automotive production that used to exist in the country, Australia will still need to have to work hard to earn its place in the global network. He indicated that, in the face of increasing global competition in the R&D space, companies like Holden and Ford must keep pushing ahead of the curve and investing heavily in R&D in Australia.

“I think the critical thing is that, regardless of what industry is carried out in Australia, it’s a sustainable business model,” Chuter said. “And there has to be recognition, awareness and understanding that markets like China, India and others are growing their own R&D capabilities rather quickly.”

And, while it may appear that Australia is fated to no longer make cars, Chuter said continued automotive R&D investment might allow Australia to keep up with the rapid pace of technological change, opening paths for advanced manufacturing – and possibly vehicle manufacturing – in the long-term.

“We’re building things like battery capability, Internet of Things (IoT) capability, and it is not impossible to think that we might build human transport products in the future,” said Chuter. “If that means doing design and engineering maintains our global relevance in the automotive industry as it stands today, then that can only good for Australia in the long-term.”